First Home Buyer Guide

Buying your first home can feel overwhelming

Rising property prices, changing lending rules, government schemes and plenty of bank jargon can make it hard to know where to start. That’s exactly why we’ve created the First Home Buyer Guide.

This practical, easy-to-follow guide is designed specifically for Australian first home buyers. It helps you understand how home loans really work, what banks look for, and how to put yourself in the strongest possible position before you buy.

Whether you are just starting to save or already thinking about pre-approval, this guide walks you through each step with clarity and confidence.

What’s inside the guide

- How banks assess first home buyers

- What counts as genuine savings

- How much deposit you really need

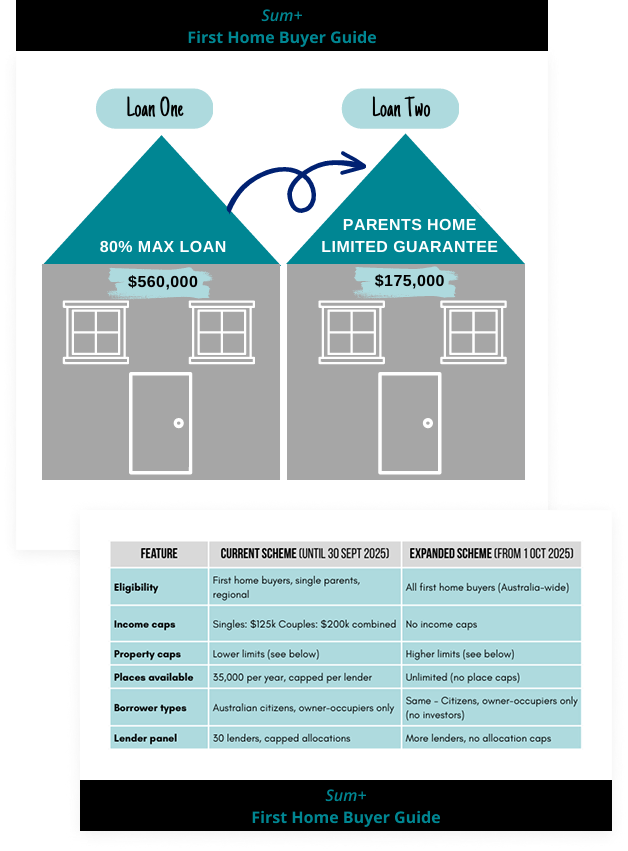

- First home buyer schemes and guarantor options explained

- The paperwork lenders will ask for

- Lending rules that can impact your approval

- Common banking terms made simple

- Understanding your options and what suits you

- What pre-approval means and how to get it right

Download the guide

Get the practical guidance you need to navigate the first home buying process. This guide will help you understand the process, make informed decisions, and move forward with certainty.

People Are Talking About SUM+

We’ve helped hundreds of homeowners and investors. Here’s what some of them say about their experience working with us.

About The Author

Adrian Bryers

Adrian has been in Lending since early 2005 covering Client Services and Credit Assessment before moving into Client Strategy and Structure with a key focus on Investment and Client Planning. Adrian’s approach to understanding a client’s situation is drawn largely from own personal experience and looking at what he would do in the same situation. His understanding of how the information at hand tells different stories is one of the many ways he helps clients find the right path for them.